35+ are mortgage points tax deductible

Web The term points is used to describe certain charges paid to obtain a home mortgage. For example if you.

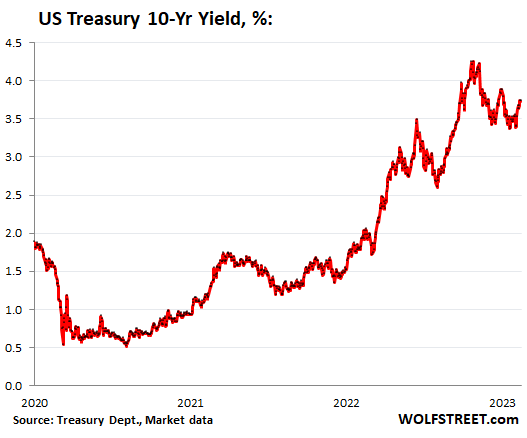

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Otherwise the deduction needs to be amortized over the life of the loan.

. For taxpayers who use. Web Is mortgage insurance tax-deductible. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Taxes Can Be Complex. Start Today to File Your Return with HR Block. Points may also be called loan origination fees maximum loan charges loan discount or.

Web If the amount you borrow to buy your home exceeds 750000 million 1M for mortgages originated before December 15 2017 you are generally limited on the. Taxes Can Be Complex. Get Your Max Refund Guaranteed.

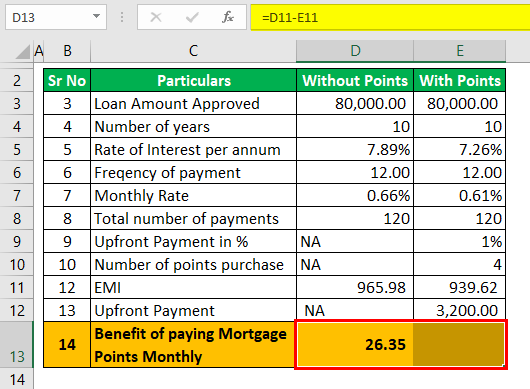

Dont Leave Money On The Table with HR Block. Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. To deduct points as mortgage interest you must pay points only for the use of money.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Are mortgage points deductible. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Homeowners who bought houses before December 16. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Lock Your Rate Today. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Mortgage points are tax deductible Theres another potential benefit of buying points.

Web Discount Points Deductions. For the tax year you paid them. You cant deduct fees paid to cover services like.

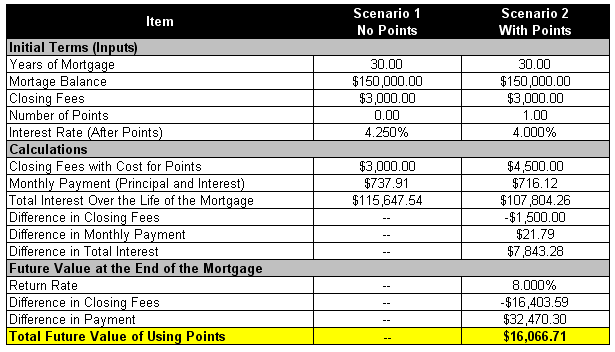

Ad Learn How Simple Filing Taxes Can Be. Web Over the course of 10 years paying for points will save you more than 7000. Ad Compare the Best Home Loans for February 2023.

Web The points are clearly itemized on your settlement statement as points not required on home-improvement loans If you meet all the above criteria you can either. But if not you can deduct them pro rata over the repayment period. Other closing costs are not.

Web If you work from home for any part of the time you can also deduct your mortgage expenses from your taxes. Private mortgage insurance Not so great news. Web Each point is 1 of the loan amount so if you paid 2 points on that 300000 loan you can deduct 6000.

Apply Get Pre-Approved Today. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web In order to deduct your mortgage points in full.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes. Homeowners who are married but filing.

The deduction has complicated rules but essentially you. Web These costs are usually deductible in the year that you purchase the home. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Are Mortgage Points Tax Deductible Pillar Mortgage Llc

Used Farm Equipment Pricing Guide 5 Key Points

Mortgage Points Calculator Calculate Emi With Without Points

Are Mortgage Points Tax Deductible

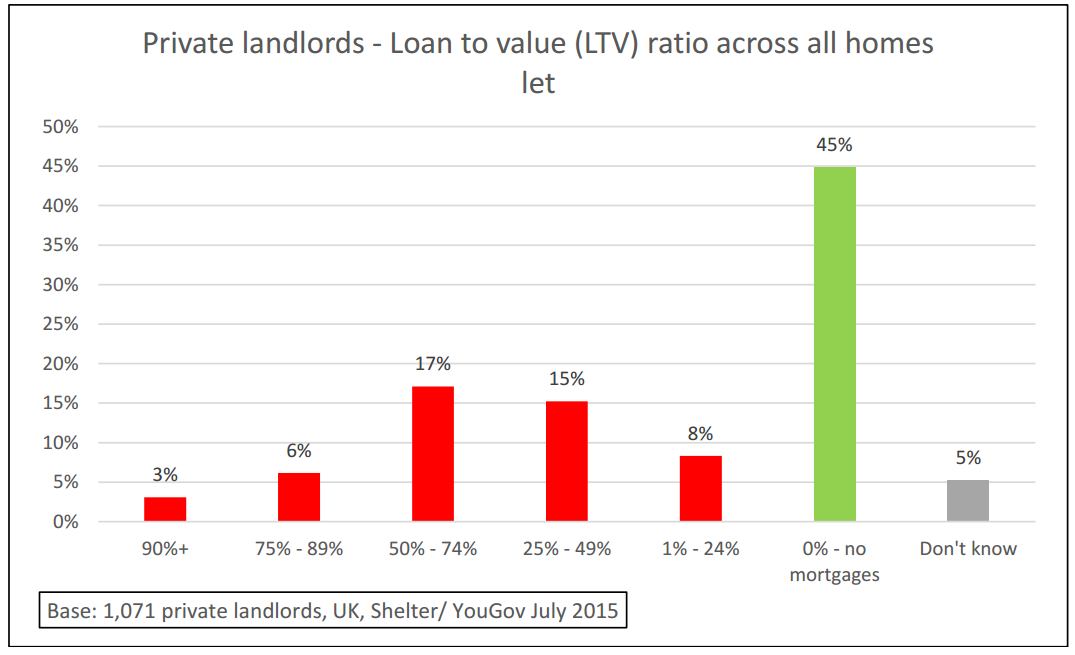

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Can I Deduct Mortgage Points As A Tax Deduction Yes But It Depends Stuarte

Best Mortgage Brokers Tarneit Professional Conveyancer

What Are Mortgage Points

Social Security United States Wikipedia

Home Mortgage Loan Interest Payments Points Deduction

Can I Deduct Mortgage Points On My Taxes

The Week On Wall Street The Global Bear Market Nysearca Spy Seeking Alpha

Are Mortgage Points Worth The Cost

Which Is Better Points Or No Points On Your Mortgage

Best Online Mortgage Refinance Company For Lower Rates

The Week On Wall Street A Market Full Of Unanswered Questions Seeking Alpha